Module 1: Introduction to the CashFlow Quadrant

– Understanding the concept and significance of the CashFlow Quadrant

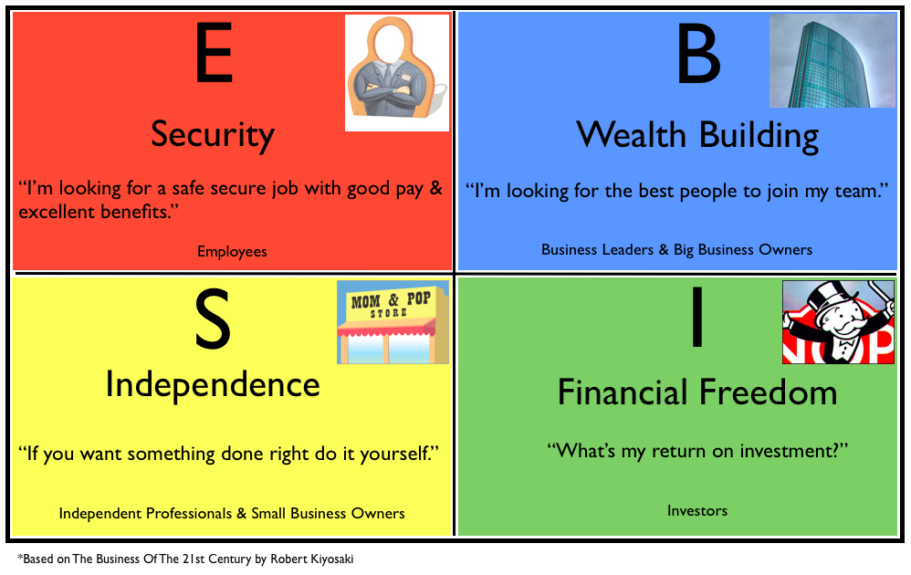

– Exploring the four quadrants: Employee, Self-Employed, Business Owner, and Investor

– Identifying the characteristics and mindset of each quadrant

– Assessing personal strengths and preferences within the Cash Flow Quadrant

– Recognizing the financial implications and opportunities in each quadrant

Module 2: Transitioning from the Employee Quadrant

– Recognizing the limitations of being an employee and the advantages of other quadrants

– Identifying transferable skills and talents for transitioning to different quadrants

– Overcoming fear and resistance to change in relation to career choices

– Exploring self-employment options, such as freelancing or starting a small business

– Developing strategies for acquiring new skills and building a personal brand

Module 3: Building a Successful Business

– Understanding the mindset and skills required to be a successful business owner

– Exploring different business models and industries

– Developing a business plan and conducting market research

– Building effective marketing and sales strategies

– Creating systems and processes for scalability and sustainable growth

Module 4: Investing for Passive Income

– Understanding the power of passive income and financial independence

– Exploring different investment vehicles, such as stocks, bonds, real estate, etc.

– Evaluating risk and return in investment opportunities

– Developing an investment plan aligned with financial goals

– Portfolio diversification and asset allocation strategies

Module 5: Creating Financial Freedom

– Integrating all quadrants to create a balanced and diversified income portfolio

– Setting and achieving financial goals for different quadrants

– Maximizing tax advantages and optimizing wealth creation strategies

– Building a strong network and leveraging connections for opportunities

– Developing a long-term wealth plan for financial freedom and legacy

Each module includes interactive discussions, case studies, exercises, and real-life examples to enhance understanding and application of the CashFlow Quadrant concepts. Encouraging participants to reflect on their own career choices and financial goals throughout the program. Provide resources and tools, such as business plan templates, investment calculators, and networking guides, to support participants’ learning and decision-making. Regularly assess participants’ progress and understanding through quizzes and assignments. Offer guidance and mentorship to help participants navigate their desired quadrant transition and achieve financial success.